Everything about Honda Of Bellingham

Everything about Honda Of Bellingham

Blog Article

Some Known Incorrect Statements About Honda Of Bellingham

Table of ContentsSome Known Details About Honda Of Bellingham The 20-Second Trick For Honda Of BellinghamHonda Of Bellingham - Questions7 Easy Facts About Honda Of Bellingham ExplainedA Biased View of Honda Of Bellingham

It's More Than Locating the Right Car. It's Discovering the Right Financing, too. When it concerns buying a new vehicle, a lot of individuals focus on locating the best automobile. How? By searching at dealerships and amongst personal sellers for the automobile they love the many. Typically, over 60% of vehicle customers finance or rent their brand-new or secondhand vehicle, several car customers consider where to fund as an afterthought.They go shopping and obtain pre-approved for financing before shopping for a car. A lorry is the second most pricey purchase that the majority of people make (after a house), so the repayment and rate of interest matter. Though you might be munching at the bit to evaluate drive that Roadster, we urge you to discover your auto loan options initially.

There are three primary resources for car fundings: dealers, banks, and cooperative credit union. They have some points in common, but recognizing their differences will assist you enter the new or pre-owned car that finest suits your needs. It's appealing to finance your new cars and truck right at the car dealership. You find the car of your dreams, arrange to pay for it, and drive it off the whole lot all within a couple of exhilarating hours.

Honda Of Bellingham Things To Know Before You Get This

Furthermore, if you enter hot water with your finance and miss out on a repayment or 2, you might discover on your own managing a lender halfway throughout the nation who has no straight partnership with you and is not inclined to be as fitting as other local banks. And yes, the dealership would choose you maintain paying the funding to make sure that they remain to make money off the interest you are paying, however if you can not, they retrieve the lorry, recover their losses, and carry on, with little to no concern for the client.

Some automakers even have their own borrowing services, like Ford Electric Motor Debt and Toyota Financial Solutions. These promotions might include extremely reduced rate of interest possibly also 0% or appealing cashback offers. Remember, however, that these bargains are generally only readily available on brand new cars and trucks and to consumers with spotless credit history.

Given that they recognize you and have a partnership with you, they might agree and able to use you a reduced rates of interest than a dealer. The bank may even use rewards to financing with them if you do all your banking under their roofing system. When financing a cars and truck with a financial institution, you have the advantage of looking around at different establishments in order to obtain a competitive deal or terms that best align with your spending plan and credit history profile.

Some Of Honda Of Bellingham

One more vital pro to funding via a bank is that you will certainly prevent surprises. Banks will check out your entire image initially, and after that assembled a loan program that fits your demands which they are positive you can translucent benefit. When that is in location, you are armed with the appropriate information you need before selecting the very best car for you.

The large con for getting your funding via a bank is that the passion rates they offer are frequently greater than the nationwide standard. Large, nationwide banks often tend to run 10-percent above typical and regional financial institutions run 24-percent over standard, while lending institution normally offer prices 19-percent listed below the national average.

Also though a conventional bank can be a superb option for funding your brand-new wheels, you might remain in far better hands at a regional lending institution. Financial institutions remain in the organization of making cash for the shareholders on top, which can translate into rate of interest that are not as affordable as those at a cooperative credit union, where the participant is likewise an owner.

The 7-Second Trick For Honda Of Bellingham

They will take into consideration extenuating conditions and emergencies that all of us can experience. A cooperative credit union is open to making adjustments and tweaks to the financing item to set you up for success. Cooperative credit union are also recognized for their remarkable participant solution. They are smaller and are spent in the neighborhood neighborhood. New Honda cars navigate to these guys Bellingham.

Once more, when you, the member, are more powerful, the credit union is more powerful. If you are currently a credit score union participant, or you are attracted to the personal touch and complete education and learning they supply, you are sure to locate an excellent lending program there for your lorry purchase.

What make and version would you truly like? If you're ready to be flexible among a few comparable options, that aids your possibilities of obtaining the ideal bargain.

Not known Incorrect Statements About Honda Of Bellingham

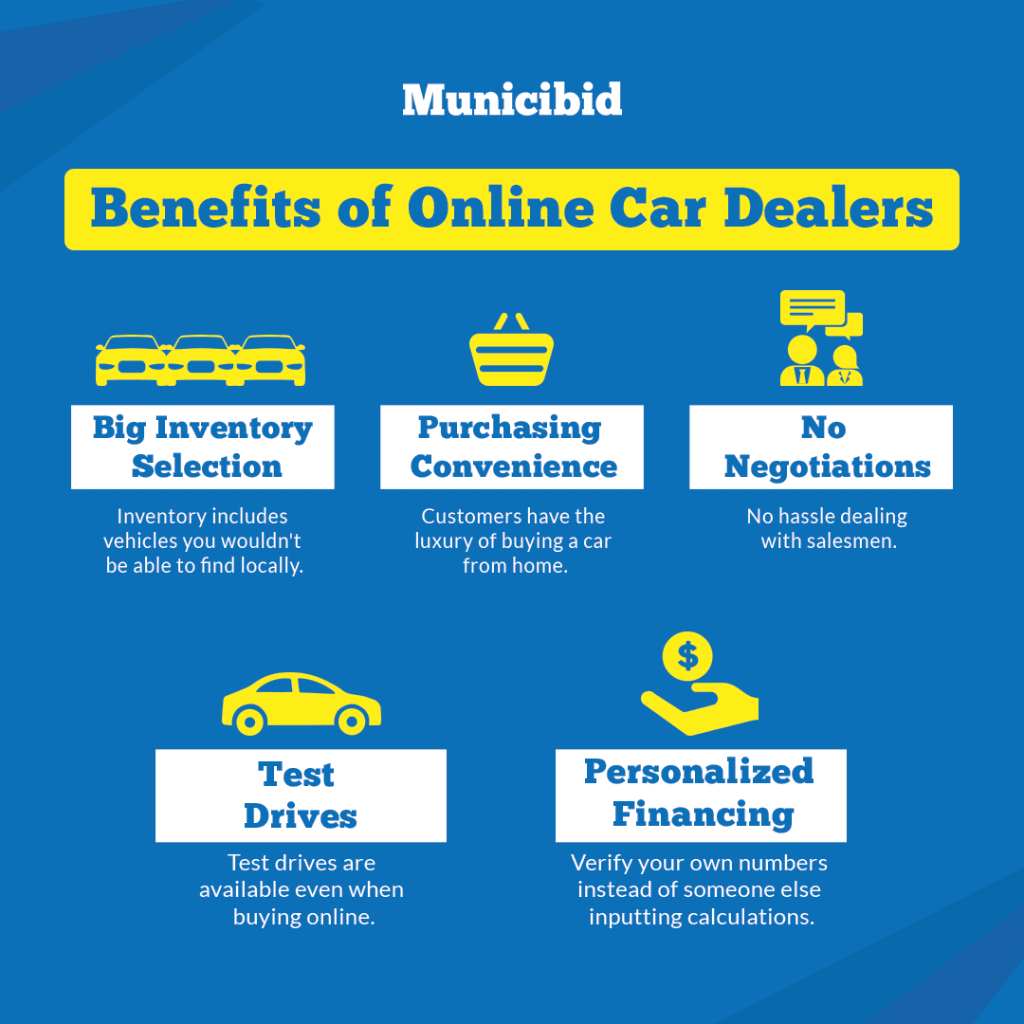

When it comes to buying a cars and truck, one of the initial decisions you need to make is whether to purchase from a car dealership or a personal vendor. Both choices have their own collection of benefits and downsides, and recognizing them can substantially influence your car-buying experience. While automobile dealerships offer a broad selection of lorries and professional solutions, personal vendors often provide an extra personalized technique and potentially reduced costs.

Report this page